Loading

Get Jm Form 4d 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JM Form 4D online

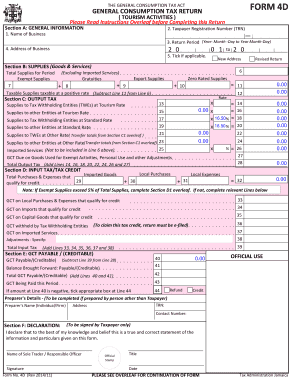

Completing the JM Form 4D online is essential for registered taxpayers in tourism activities to report their general consumption tax. This guide provides a clear and detailed overview of each section of the form to ensure accurate submission.

Follow the steps to fill out the JM Form 4D accurately.

- Press the ‘Get Form’ button to access the JM Form 4D online in your preferred format.

- In Section A, enter your general information. Provide the name of your business as it appears on your GCT Certificate of Registration, tax registration number (TRN), and address of the business. Make sure to select the applicable year and month for the return date using the correct format.

- Move to Section B, which focuses on Supplies (Goods & Services). Report all sales or services rendered during the specified return period. This includes the full value of any services charged along with applicable fees.

- In Section C, calculate the output tax based on the supplies you reported in the previous section. Ensure to treat any imported services as deemed supply and note the applicable tax rates.

- Proceed to Section D to report input tax or tax credits. This includes details of all applicable local purchases, local expenses, and imported goods during the period. Make sure to fill in the required amounts accurately to activate calculations.

- In Section E, determine your GCT payable or creditable. Subtract your total input tax from your total output tax. Indicate how any credit should be treated by checking the appropriate box if applicable.

- Finalize your form by completing the declaration in Section F. Enter the name of the sole trader or responsible officer, provide a signature, and date the form to affirm that all information is true and correct.

- Once all fields are completed, save your changes. You can then proceed to download, print, or share the form as necessary.

Complete your JM Form 4D online for accurate tax reporting today!

In general, Jamaican residents and domiciled individuals are taxed on their worldwide income, while non-resident individuals are taxed on Jamaican-sourced income. A non-Jamaican domiciled individual is generally not taxable on foreign-sourced income unless one remits this to Jamaica.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.