Loading

Get Ma Dor Form 84 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR Form 84 online

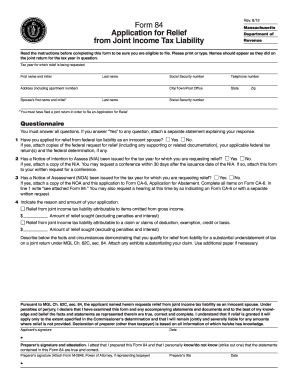

Filling out the Massachusetts Department of Revenue Form 84, which is the application for relief from joint income tax liability, can seem daunting. This guide offers a structured, step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the MA DoR Form 84 online.

- Click the 'Get Form' button to obtain the form and open it in the designated editor.

- Indicate the tax year for which you are requesting relief by entering the relevant year in the designated field.

- Provide your first name, middle initial, last name, and current address, including apartment number if applicable.

- Enter your spouse's first name, middle initial, and last name in the specified fields. Remember that you must have filed a joint return to submit this application.

- Fill in your social security number and that of your spouse, ensuring accuracy as this information is critical for processing your application.

- Input your telephone number and full address details including city, state, and zip code.

- Complete the questionnaire section by answering all question prompts. For any 'Yes' responses, ensure you attach a separate statement and any necessary documentation as instructed.

- Clearly indicate the reason and amount of your application for relief, detailing the items contributing to your request.

- Use the provided space to describe circumstances that support your claim for relief. Ensure to attach any documents that substantiate your statements.

- Review your completed form for accuracy and completeness. Once confirmed, you can save changes, download, print, or share the form as needed.

Take the first step toward financial relief by completing your MA DoR Form 84 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Innocent spouse relief can relieve you from paying additional taxes if your spouse understated taxes due on your joint tax return and you didn't know about the errors. Innocent spouse relief is only for taxes due on your spouse's income from employment or self-employment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.