Loading

Get Fnma 176 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fnma 176 Form online

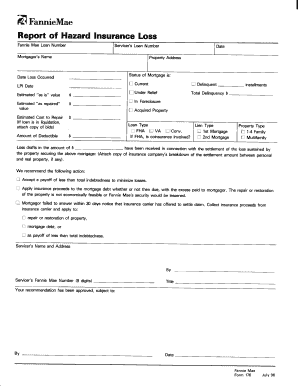

The Fnma 176 Form is essential for servicers to seek approval for the disposition of hazard insurance loss proceeds related to certain mortgages. This guide provides a comprehensive, user-friendly approach to ensure users can complete the form accurately and efficiently online.

Follow the steps to successfully fill out the Fnma 176 Form.

- Click the ‘Get Form’ button to access the Fnma 176 Form and open it in your preferred editor.

- Begin by filling in the servicer's contact information. This typically includes the name, address, phone number, and email address to ensure communication is clear and timely.

- Next, detail the property information related to the mortgage, including the property address and loan number. Accurate information is crucial for processing.

- In the section regarding the nature of the loss, provide detailed descriptions of the damage sustained by the insured improvements. Be as specific as possible to facilitate the review.

- Indicate whether the servicer believes that repair or restoration of the property is economically feasible. Your assessment will guide the next steps in the loss disposition process.

- If applicable, confirm if a proof of loss has been filed with the insurance carrier on behalf of Fannie Mae. This ensures all necessary documentation is accounted for.

- Review the filled-out form for accuracy and completeness before proceeding. It is important to verify all information to avoid delays in processing.

- Finally, save your changes, and you can proceed to download, print, or share the completed Fnma 176 Form as needed.

Take the next step and complete your documents online today.

Proving income as a self-employed individual requires organized financial records. Utilize your tax returns, profit and loss statements, and bank statements to support your income claims. When completing the Fnma 176 Form, having clear documentation enhances your chances of mortgage approval. Consistency and transparency in your reports are critical.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.