Get Ct W-298 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT W-298 online

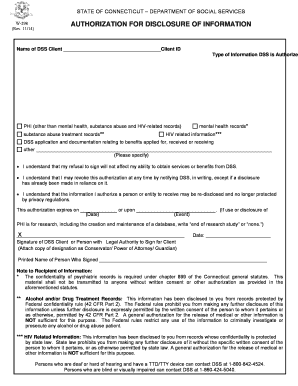

The CT W-298 form is an important document used to authorize the disclosure of your personal information by the Department of Social Services in Connecticut. This guide will provide you with clear and supportive instructions on how to complete the form online.

Follow the steps to accurately fill out the CT W-298 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the name of the DSS client in the designated field, along with the Client ID that is provided to you by DSS.

- Next, indicate the name and address of the person or entity to whom the information is being disclosed. This should clearly identify the recipient.

- In the section for purposes, specify the reason for the disclosure. If you prefer not to state a purpose, you may write 'at my request.'

- Select the type of information you are authorizing to be disclosed by checking the appropriate boxes. Be mindful of sensitive information such as mental health records and substance abuse treatment records.

- Acknowledge your understanding of the implications of your authorization by reading the provided statements. This includes awareness of your right to revoke the authorization.

- Indicate the expiration date for the authorization, or specify an event that would terminate it. This is essential for limiting the duration of the disclosure.

- Sign the form in the space provided, either as the DSS client or as a person with legal authority to sign for the client. Ensure that you attach any required documentation that confirms your authority.

- Include the date of signing the form and print your name clearly in the space provided.

- Once all fields are filled out correctly, you can save your changes, download the completed form, print it for your records, or share it as needed.

Complete your documents online today to ensure timely and accurate processing.

The CT energy tax credit is a financial incentive aimed at promoting energy efficiency and renewable energy usage among residents and businesses in Connecticut. This credit allows individuals to receive a reduction in their tax liabilities for investing in energy-efficient upgrades and renewable energy systems. To benefit from this program, you may need to file specific documentation, including forms similar to the CT W-298. Always check the latest regulations to maximize your benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.