Get Ncua 4012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NCUA 4012 online

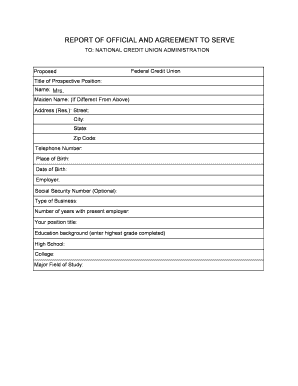

The NCUA 4012 form is essential for individuals designated to serve in official capacities within a federally insured credit union. This guide provides a comprehensive, step-by-step approach to help users complete the form online with clarity and confidence.

Follow the steps to fill out the NCUA 4012 form online.

- Press the ‘Get Form’ button to access the form and open it in the digital editor.

- Begin by entering your personal information. Fill in the proposed title of the position you will occupy, followed by your full name, maiden name (if applicable), residential address, telephone number, place of birth, and date of birth.

- Provide your employer's name, social security number (optional), type of business, length of time at your current job, and your position title.

- Indicate your education background by listing your highest completed grade, high school information, college attended, and your major field of study.

- Detail any other training or relevant experience you have had.

- Respond to the questions regarding your willingness to accept the position and your understanding of the duties involved by selecting 'Yes' or 'No'.

- If applicable, provide an estimate of the number of hours per month you can volunteer and answer the question about previous criminal convictions that may involve dishonesty or trust breaches.

- Complete any additional information required, including previous names used, past addresses if applicable, and the name of your partner or spouse.

- In the certification section, confirm that all information provided is accurate and sign the document. Include the date of signing.

- Finally, review your entries, make any necessary adjustments, and save your changes. You can then download, print, or share the completed form as needed.

Start filling out the NCUA 4012 form online today to ensure a smooth application process.

The NCUA is led by its board, with the chairman serving as the primary spokesperson and representative. Each board member brings expertise and perspective, working together to oversee the administration and regulation of credit unions. Their leadership is essential in ensuring that credit unions thrive while adhering to regulations that protect the members. If NCUA 4012 is on your radar, understanding the leadership dynamics can enhance your strategic planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.