Loading

Get Irs Form 56 2004 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 56 2004 online

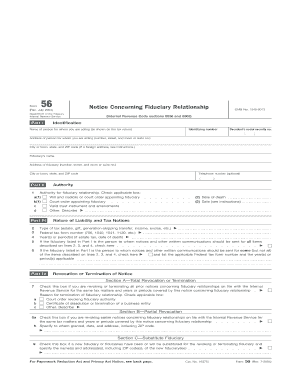

IRS Form 56 is essential for notifying the IRS about the creation or termination of a fiduciary relationship. This guide provides step-by-step instructions to help users fill out the form online accurately and efficiently.

Follow the steps to complete the IRS Form 56 2004 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred form editor.

- Fill in Part I - Identification. This section requires the name, identifying number, and address of the person for whom you are acting, as well as the fiduciary's name and address. Ensure accurate details are entered.

- Complete Part II - Authority. Indicate the authority for the fiduciary relationship by checking the appropriate box, such as a will or court order, and provide the necessary dates.

- In Part III - Nature of Liability and Tax Notices, specify the type of tax, federal tax form number, and year(s) or period(s) related to the tax matter.

- If applicable, check the boxes in Part III for the fiduciary to receive notices for all or some specified items. Ensure the details are clear and correctly filled in.

- Moving to Part IV - Revocation or Termination of Notice, check the boxes that apply if you are revoking or terminating earlier notices. Provide reasons and additional details as necessary.

- Fill out Part V - Court and Administrative Proceedings. If you have relevant court information or case details, indicate these as instructed.

- Finally, complete Part VI - Signature. Sign the form, include your title if applicable, and date it to certify that you possess the authority to act as a fiduciary.

- After reviewing all entries for accuracy, you can save changes, download, print, or share the completed form as required.

Make sure to complete all necessary documents online accurately and submit them promptly.

If you're looking to file without using electronic means, the IRS Form 56 2004 is your go-to document. This form serves as a notification of a fiduciary relationship and can be mailed to the IRS. It's important to ensure that all required information is accurate before sending it out. For individuals who prefer paper filing, using IRS Form 56 2004 is a reliable choice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.