Loading

Get Canada Pd24 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada PD24 online

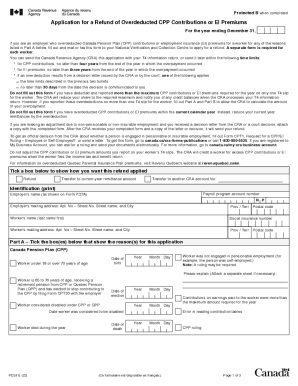

Filling out the Canada PD24 form is an essential process for employers seeking a refund of overdeducted Canada Pension Plan (CPP) contributions or Employment Insurance (EI) premiums. This guide provides clear steps to assist you in completing the form accurately and effectively, ensuring that you can submit your application successfully.

Follow the steps to complete the Canada PD24 online

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Provide your identification details by entering your payroll program account number, the employer's name exactly as it appears on Form PD7A, and the employer's mailing address including the apartment number, street number, street name, city, province or territory, and postal code.

- Fill out the worker's information by inputting the worker's name (last name first), social insurance number, mailing address, and postal code.

- In Part A, select the appropriate reasons for the application by ticking the relevant boxes for both CPP and EI, including additional explanations if necessary. Ensure you include any necessary dates such as the birth date or death date of the worker, or dates of elections or decisions.

- Complete Part B by listing the details for all pay periods within the year, including the applicable earnings, contributions deducted, required contributions, and total overpayment amounts. This section is vital for the CRA to calculate your refund accurately.

- In the certification section, the employer or an authorized officer must print their name, certify the correctness of the information, provide the date, and include their signature, position, and telephone number.

- Finally, save your changes, and choose to download, print, or share the completed Canada PD24 form as needed.

Take the first step toward your refund by completing the Canada PD24 online now.

Overpayment of Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) If you were not living in Quebec before you left Canada, go to Line 44800 – CPP overpayment. If you were living in Quebec, any overpayment of CPP or QPP contribution will be refunded or used to reduce your balance on your federal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.