Loading

Get Fill In Substitute 1099 S Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In Substitute 1099 S Form online

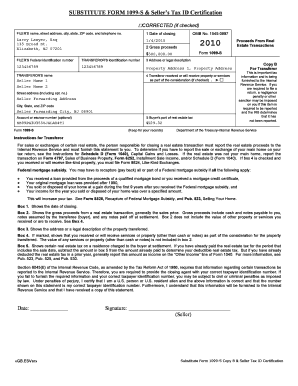

Filling out the Fill In Substitute 1099 S Form online is essential for reporting real estate transactions to the Internal Revenue Service. This guide will provide you with a clear and structured approach to completing the form accurately.

Follow the steps to complete the Fill In Substitute 1099 S Form online.

- Click ‘Get Form’ button to download the Fill In Substitute 1099 S Form and open it for editing.

- Enter the filer's name, street address, city, state, ZIP code, and telephone number in the designated fields. This identifies the person or entity reporting the income.

- Fill in the date of closing, indicating when the real estate transaction occurred.

- In the gross proceeds section, specify the total amount received from the transaction. Make sure to include all forms of payment.

- Provide the filer's federal identification number and the transferor's identification number. These numbers are critical for IRS identification.

- Input the address or legal description of the property associated with the transaction in the appropriate section.

- If applicable, check the box indicating whether the transferor received or will receive property or services as part of the agreement, and provide the necessary details.

- Enter the buyer's part of the real estate tax if this amount was charged at settlement. This may affect tax liabilities.

- After completing all fields, review the information for accuracy and completeness.

- You can then save changes, download the completed form, print it for your records, or share it as needed.

Complete your documents online now for a smooth filing process.

No, a 1099 is not the same as a W-2. A 1099 form reports income from various sources like freelance work or rental income, while a W-2 form reports wages for employees from an employer. If you're working freelance or as an independent contractor, you will likely receive a 1099, while traditional employees receive a W-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.