Loading

Get Certification For No Information Reporting Form Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certification For No Information Reporting Form Irs online

This guide provides a comprehensive overview of how to complete the Certification For No Information Reporting Form Irs. By following these clear steps, you can ensure that your form is accurately filled out and submitted.

Follow the steps to fill out the Certification Form accurately.

- Click ‘Get Form’ button to access the Certification For No Information Reporting Form Irs and open it in your preferred editing tool.

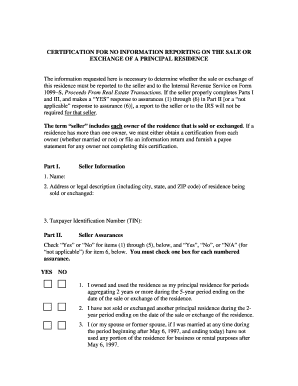

- Begin by filling out Part I, which requires your personal information. Provide your full name, the address or legal description of the residence being sold or exchanged (including city, state, and ZIP code), and your Taxpayer Identification Number (TIN).

- Proceed to Part II regarding seller assurances. You must check ‘Yes’ or ‘No’ for items (1) through (5), and ‘Yes’, ‘No’, or ‘N/A’ for item 6. Make sure to check only one box for each assurance listed.

- In item (1), confirm whether you owned and used the residence as your principal residence for periods aggregating 2 years or more during the last 5 years.

- In item (2), confirm whether you have not sold or exchanged another principal residence in the last 2 years.

- In item (3), indicate if you or a spouse used any portion of the residence for business or rental purposes after May 6, 1997.

- In item (4), assess the criteria regarding the sale or exchange value and confirm your eligibility by selecting the appropriate statement.

- In item (5), confirm that you did not acquire the residence in an exchange under section 1031 of the Internal Revenue Code during the last 5 years.

- Finally, complete Part III by indicating if your basis in the residence refers back to a person who acquired it in an exchange under section 1031 and that this occurred more than 5 years prior.

- Sign and date the form in the designated area to certify that all information provided is true and accurate as of the end of the sale or exchange day.

Take action and complete the Certification For No Information Reporting Form Irs online today.

You can receive a 1099 form from the payer who made payments to you during the tax year. They are required to send you this form if you meet the criteria. For assistance in managing your forms and understanding Certification for No Information Reporting Form IRS, USLegalForms provides various tools that can make this process easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.