Get Ca Form Llc-2 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

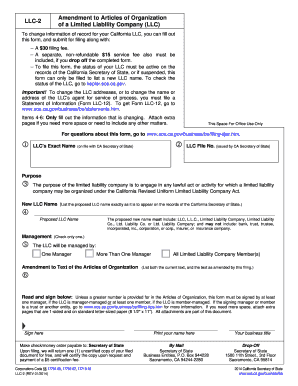

How to fill out the CA Form LLC-2 online

The CA Form LLC-2 is essential for making amendments to the articles of organization for your limited liability company in California. This guide provides step-by-step instructions to help you accurately complete this form online, ensuring that you meet all legal requirements with ease.

Follow the steps to complete your CA Form LLC-2 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the LLC's exact name as it is filed with the California Secretary of State. This ensures that the records are updated accurately.

- Input the LLC file number that was issued by the California Secretary of State to maintain a clear connection to your entity.

- State the purpose of the limited liability company. This can be a general statement that the LLC will engage in any lawful act for which it can be organized.

- If applicable, provide the proposed new LLC name. Ensure that it complies with naming requirements by including ‘LLC’ or appropriate variations and avoiding restricted terms.

- Indicate the management structure by checking one of the options: 'One Manager' or 'More Than One Manager.' Choose the appropriate governance model based on your LLC's structure.

- For amendments to the text of the articles of organization, list both the current text and the amended text. Make sure to provide clear and complete information.

- Sign the form. At least one manager or member must sign, depending on the management structure. Ensure the signature is legible and matches the printed name provided.

- After filling out the form, review all entries for accuracy and completeness. Attach any necessary pages if more space is needed.

- Save your changes. You can then download, print, or share the completed form as needed.

Take action today and complete your CA Form LLC-2 online to update your LLC's information.

Get form

To avoid the $800 tax in California for your LLC, you need to ensure timely filing and compliance with state regulations. One effective strategy is to file your CA Form LLC-2 appropriately. This form allows you to make necessary elections that may help lower your tax liability. Additionally, you can explore whether your LLC qualifies for exemptions based on specific business activities or earnings.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.