Loading

Get Form 8023 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8023 online

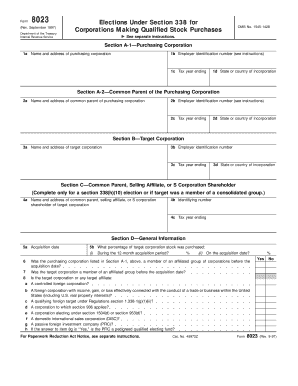

Form 8023 is essential for corporations making qualified stock purchases under Section 338. This guide will help users navigate the process of filling out the form online, ensuring all necessary information is accurately provided for a smooth filing experience.

Follow the steps to complete Form 8023 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section A-1, provide the name and address of the purchasing corporation along with its employer identification number and tax year ending. Ensure that the state or country of incorporation is also included.

- In Section A-2, enter the details for the common parent of the purchasing corporation, including its name, address, employer identification number, tax year ending, and incorporation state or country.

- Proceed to Section B to input information regarding the target corporation. Fill in the name, address, employer identification number, tax year ending, and state or country of incorporation.

- In Section C, only complete this if applicable for a Section 338(h)(10) election. Provide the name and address of the common parent, selling affiliate, or S corporation shareholder of the target corporation along with necessary identifying number and tax year ending.

- In Section D, record the acquisition date and the percentage of target corporation stock purchased during the 12-month acquisition period and on the acquisition date. Answer questions regarding the affiliated group status of both the purchasing and target corporations before the acquisition date.

- Section E requires detailed financial information about the purchasing corporation's statement, including stock price, acquisition costs, target liabilities, and income taxes on deemed sale. Answer the relevant questions regarding agreements or contracts related to the transaction.

- If you are completing Section F, enter the seller’s statement information only for a Section 338(h)(10) election, detailing stock price, target liabilities, selling costs, and relevant asset classifications.

- In Section G, indicate applicable elections under section 338 by checking the relevant boxes based on the type of election being made.

- Finally, ensure that the form is signed by authorized persons for both the purchasing corporation and the common parent if applicable, along with the date and title. Save changes, download, print, or share the completed form as needed.

Complete your Form 8023 online today to ensure compliance and streamline your filing process.

Form 8838 is used for gain recognition agreements under Internal Revenue Code sections 367(a) and 367(e)(2).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.