Loading

Get Ie Form 11 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form 11 online

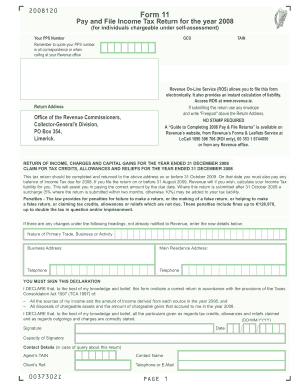

Filling out the IE Form 11 online is essential for self-assessment income tax returns in Ireland. This guide provides step-by-step instructions to help users navigate through each section and complete the form accurately.

Follow the steps to successfully complete the IE Form 11 online

- Press the ‘Get Form’ button to access the IE Form 11 and open it in your preferred editor.

- Begin by entering your Personal Public Service (PPS) number. This number is crucial for all correspondence with the Revenue office and should be included wherever necessary.

- Complete the Personal Details section. Indicate your marital status, the number of dependent children, and provide any changes in personal circumstances that occurred in 2008.

- Review your income from trades, professions, or vocations. Fill in details about any income, including the type of trade or business and the associated profits or losses.

- If applicable, carefully complete the sections related to Irish rental income, income from Irish employments, and foreign income. Ensure accurate reporting of all sources and amounts.

- In the claim sections, enter any tax credits, allowances, and reliefs you are eligible for, such as the Home Carer Tax Credit or PAYE Tax Credit.

- After completing all sections, review your entries for accuracy, ensuring you follow the specific instructions like using capital letters where required.

- Once satisfied, save your changes. You can then download, print, or share the completed form as needed to finalize your submission.

Complete your IE Form 11 online today to ensure your taxes are filed accurately and on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To maximize your tax refund, ensure that you claim all allowable deductions and credits. Utilize tax preparation software to help identify opportunities for reducing your taxable income. The IE Form 11 can also assist you in accurately reporting your financial data, helping to avoid any oversights that could impact your refund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.