Loading

Get Nj St-7 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ ST-7 online

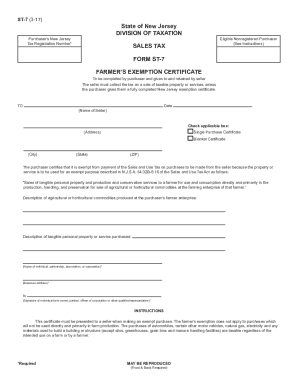

Filling out the NJ ST-7 form online can simplify the process of claiming a farmer’s exemption from sales tax in New Jersey. This guide will walk you through each section of the form to ensure you accurately complete it and meet the necessary requirements.

Follow the steps to effectively complete the NJ ST-7 form online.

- Press the 'Get Form' button to access the NJ ST-7 form and open it for editing.

- Begin filling out the form by entering the purchaser's New Jersey tax registration number in the designated field at the top of the form.

- In the 'To' section, input the name and address of the seller, ensuring to specify the date.

- Provide a description of the agricultural or horticultural commodities produced at your farming enterprise.

- Include the name of the individual, partnership, association, or corporation that is purchasing the items.

- Ensure that the form is signed by the individual farm owner, partner, officer of the corporation, or another qualified representative to finalize the exemption certificate.

- Review all entries for accuracy before saving your changes. After completing the form, you can download, print, or share the NJ ST-7 as needed.

Complete your NJ ST-7 form online today to ensure a smooth exemption process.

Sales of tangible personal property as well as production and conservation services to a farmer are exempt from New Jersey sales and use tax when used directly and primarily in the production, handling and preservation for sale of agricultural or horticultural commodities at the farming enterprise of that farmer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.