Loading

Get Irs 941-x 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-X online

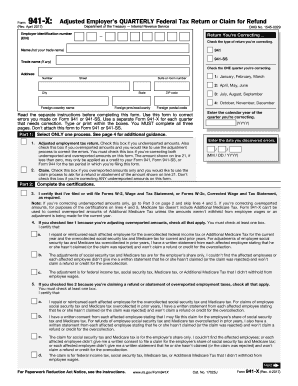

Filling out the IRS 941-X form is an essential step for employers who need to correct errors on their previously filed IRS 941 or 941-SS forms. This guide provides a clear, step-by-step approach to help you navigate each section of the form with confidence.

Follow the steps to complete the IRS 941-X form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in your employer identification number (EIN) and indicate the type of return you are correcting, either 941 or 941-SS. Also, select the quarter you are correcting. Make sure to include your name and address information.

- In Part 1, select the appropriate process for your corrections by checking either the adjustment box if you underreported amounts, or the claim box if you want to request a refund for overreported amounts.

- Complete Part 2 by certifying that you have filed the necessary Forms W-2 or W-2c. Depending on your selection in Part 1, provide any additional certifications required.

- Proceed to Part 3, where you will enter the corrections for wages, taxes, and other relevant amounts. Utilize the columns to indicate the total corrected amount, the amount originally reported, and the resulting difference.

- In Part 4, offer a detailed explanation of your corrections, especially if there are both underreported and overreported amounts or if reclassified workers are involved.

- Finally, in Part 5, make sure to complete all required signatures and date the form. Remember that you must complete all three pages of the form.

- Once finished, review your form for accuracy, then save your changes, download a copy, print it, or share the form as needed.

Complete your IRS 941-X form online today for efficient and accurate corrections.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.