Loading

Get Sc Dor Sc1120 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1120 online

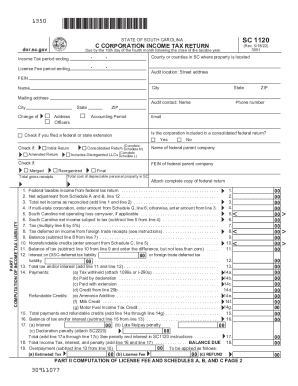

Filling out the SC DoR SC1120 form is an essential step for corporations in South Carolina to report their income tax return. This guide will provide you with clear and straightforward instructions on how to complete the form effectively and accurately online.

Follow the steps to fill out the SC DoR SC1120 online.

- Click ‘Get Form’ button to obtain the SC DoR SC1120 and open it in the editor.

- Begin filling out the form by entering your corporation's name and FEIN in the designated fields. Ensure that all information is accurate and aligns with your federal return.

- Provide the income tax period ending date and the license fee period ending date as required in the specified sections.

- Indicate whether the corporation is included in a consolidated federal return by selecting 'Yes' or 'No'. If applicable, mention the name and FEIN of the federal parent company.

- Fill in details about total gross receipts, cost of depreciable personal property in South Carolina, and federal taxable income as per the federal return.

- Calculate total net income as reconciled and complete the ‘net operating loss carryover’ field if relevant.

- Complete the license fee computation section and calculate any applicable credits or balances.

- Sign and date the form, ensuring that any required signatures from officers and preparers are included.

- After completing all sections, review your inputs thoroughly for accuracy and then proceed to save changes, download, print, or share the completed form as necessary.

Complete your SC DoR SC1120 online today for a hassle-free filing experience.

Related links form

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.