Loading

Get Mi Form 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi Form 4 online

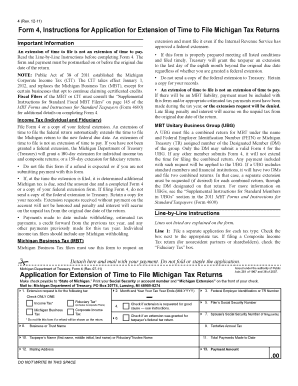

Filling out the Mi Form 4 online is an essential step for those seeking an extension of time to file Michigan tax returns. This guide provides a step-by-step walkthrough of the form's components, ensuring you complete it accurately and efficiently.

Follow the steps to fill out the Mi Form 4 online with ease.

- Press the ‘Get Form’ button to access the Mi Form 4 and open it in an editor.

- Begin by checking the appropriate box on line 1 to indicate the type of tax for which you are requesting an extension. Ensure you complete a separate application for each tax type.

- On line 2, enter the month and year your tax year ends, following the format MM-YYYY. For individual income tax filers, this is typically December of the tax year.

- Input your Federal Employer Identification Number (FEIN) or Taxpayer Registration (TR) Number in line 3, depending on your tax type. Individual filers should use their Social Security Number in line 5.

- If applicable, include your spouse’s Social Security Number in line 7 for joint filings and provide the business or trust name along with your own name in the respective fields.

- Fill out lines 9 and 11 with the tentative annual tax and total payments made to date, ensuring these figures reflect your latest estimates.

- Complete line 4 if you have not received a federal extension and are requesting one for good cause, such as an initial or final return. Note that inability to pay is not considered good cause.

- Confirm if you have been granted a federal extension by checking the box on line 6. Keep a copy of this federal extension for verification purposes.

- Once all fields are accurately filled, detach the form from the instructions and prepare it for mailing. Include payment if required to avoid penalties.

- Finally, save your changes, download a copy for your records, and print or share the form as needed before mailing it to the Michigan Department of Treasury.

Complete your tax documents online today to ensure timely filing and avoid penalties.

Yes, Missouri has its own state withholding form, similar to the W4 for federal taxes. If you are working in Missouri and need to ensure the correct state taxes are withheld, completing their state form is essential. For users in different states, including Michigan, exploring our resources on uslegalforms can guide you through the process of filling out relevant forms like the Mi Form 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.