Get Canada Ibc Claim Form No. 3 Gst 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada IBC Claim Form No. 3 GST online

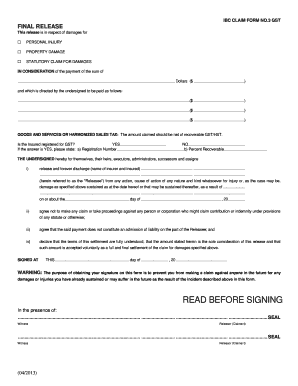

Filling out the Canada IBC Claim Form No. 3 GST online can be straightforward when you have the right guidance. This form is essential for claiming damages related to personal injuries, property damage, or statutory claims, ensuring that your claims process is properly documented.

Follow the steps to complete your form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the type of claim from the options provided: personal injury, property damage, or statutory claim for damages.

- Indicate the total amount you are claiming in the space provided, ensuring that the figure reflects the net of any recoverable GST/HST.

- If you are registered for GST, mark 'Yes' and fill in your registration number and the percentage recoverable. If not, select 'No.'

- Complete the section detailing the Releasee. You will need to provide the names of the insurer and the insured involved in the claim.

- Review and confirm the terms of the release, including your agreement not to file further claims once signed.

- Sign and date the form in the designated area, ensuring that it is completed in the presence of a witness for validity.

- After completing the form, you can save any changes, then download, print, or share the document as necessary.

Take the next step and fill out your Canada IBC Claim Form No. 3 GST online today.

The choice between filing a claim with your insurance or the other party's depends on various factors, including the nature of the accident and your policy details. If you file with your own insurer, you may receive faster assistance and be familiar with their claims process. However, pursuing the other party's insurance can sometimes be more beneficial, especially if their policy covers the damages comprehensively. Always weigh your options and processes, such as the Canada IBC Claim Form No. 3 GST, to make an informed decision.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.