Loading

Get Nj Nj-1040 Schedule Nj-dop 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040 Schedule NJ-DOP online

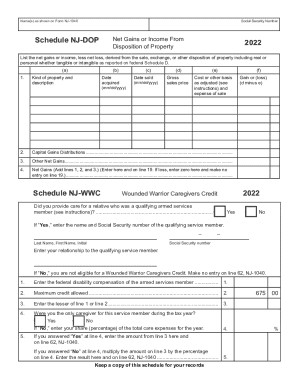

Filling out the NJ NJ-1040 Schedule NJ-DOP is an important step for reporting net gains or income from the disposition of property in New Jersey. This guide provides clear and supportive instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your NJ NJ-1040 Schedule NJ-DOP online.

- Press the ‘Get Form’ button to access the Schedule NJ-DOP and open it in your editor.

- Enter the name(s) as shown on Form NJ-1040 in the designated section for identification.

- Fill in your Social Security number to ensure proper identification and processing of your form.

- Report net gains or income derived from property transactions by listing details of each transaction: type of property, acquisition date, sale date, gross sales price, and cost or basis adjusted as needed.

- For Section 2, if applicable, enter capital gains distributions from Form 1099-DIV or similar statements.

- In Section 3, report other net gains or losses from property not included in previous sections.

- Calculate your net gains by adding up the totals from lines 1, 2, and 3 and enter the final figure in line 4. If there is a loss, enter zero.

- If you are applying for the Wounded Warrior Caregivers Credit, answer the relevant questions and provide the required information about the qualifying service member if applicable.

- Review your entries for accuracy and completeness before finalizing the form.

- Once completed, save changes, download, print, or share the form as necessary.

Begin filling out your NJ NJ-1040 Schedule NJ-DOP online today to ensure accurate reporting of your property income.

The IRS defines adjusted gross income as “gross income” minus “adjustments to income.” Gross income includes your wages, dividends, capital gains, business income, retirement distributions and other income. Then there are some payments you make that can be deducted or excluded from that amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.