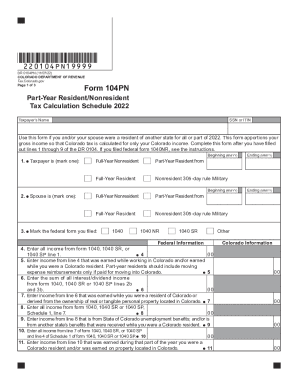

Get Co Dor 104pn 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO DoR 104PN online

How to fill out and sign CO DoR 104PN online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a legal professional, making a scheduled visit and going to the workplace for a private meeting makes completing a CO DoR 104PN from beginning to end tiring. US Legal Forms enables you to quickly create legally valid documents according to pre-constructed web-based blanks.

Perform your docs within a few minutes using our simple step-by-step guideline:

- Get the CO DoR 104PN you need.

- Open it up with online editor and start editing.

- Fill in the empty fields; engaged parties names, places of residence and numbers etc.

- Customize the blanks with smart fillable areas.

- Put the date and place your e-signature.

- Simply click Done following twice-checking everything.

- Download the ready-created document to your device or print it like a hard copy.

Rapidly generate a CO DoR 104PN without having to involve specialists. We already have over 3 million people benefiting from our rich library of legal forms. Join us today and get access to the #1 library of online samples. Try it out yourself!

How to edit CO DoR 104PN: customize forms online

Find the right CO DoR 104PN template and edit it on the spot. Streamline your paperwork with a smart document editing solution for online forms.

Your everyday workflow with paperwork and forms can be more effective when you have everything you need in one place. For instance, you can find, get, and edit CO DoR 104PN in one browser tab. If you need a particular CO DoR 104PN, you can easily find it with the help of the smart search engine and access it immediately. You do not have to download it or look for a third-party editor to edit it and add your data. All of the tools for efficient work go in one packaged solution.

This editing solution enables you to customize, fill, and sign your CO DoR 104PN form right on the spot. Once you see a suitable template, click on it to open the editing mode. Once you open the form in the editor, you have all the essential tools at your fingertips. It is easy to fill in the dedicated fields and remove them if needed with the help of a simple yet multifunctional toolbar. Apply all the changes immediately, and sign the form without exiting the tab by simply clicking the signature field. After that, you can send or print your document if necessary.

Make more custom edits with available tools.

- Annotate your document with the Sticky note tool by placing a note at any spot within the document.

- Add required visual components, if required, with the Circle, Check, or Cross tools.

- Modify or add text anywhere in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Modify the template text with the Highlight and Blackout, or Erase tools.

- Add custom visual components with the Arrow and Line, or Draw tools.

Discover new options in efficient and trouble-free paperwork. Find the CO DoR 104PN you need in minutes and fill it in in the same tab. Clear the mess in your paperwork for good with the help of online forms.

The DR 88454 replaces the DR 8453 for tax year 2022 and forward.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.