Loading

Get Ny It-258 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-258 online

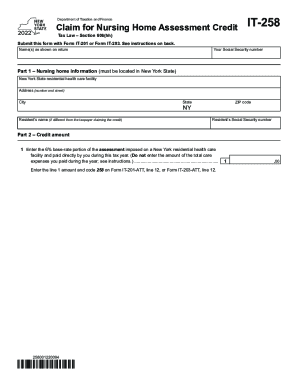

The NY IT-258 form allows individuals to claim a credit for the assessment imposed on residential health care facilities in New York State. This guide provides a clear and concise step-by-step process for filling out this form online to ensure you receive the credits you are entitled to.

Follow the steps to complete the NY IT-258 accurately.

- Press the ‘Get Form’ button to access the NY IT-258 form and open it in your preferred online document editor.

- In Part 1, provide the name and address of the New York residential health care facility where services were rendered. If the resident differs from the tax filer, include the resident’s name and Social Security number.

- Move to Part 2 and enter the amount for the 6% base-rate portion of the assessment directly paid by you during the tax year on Line 1. Ensure this amount is the assessment portion, not the total care expenses.

- Transfer the amount from Line 1 and code 258 onto Form IT-201-ATT, line 12, or Form IT-203-ATT, line 12 as instructed.

- Review all entries for accuracy before saving your changes. You may then proceed to download, print, or share the completed form as necessary.

Complete your documents online today to make the process easy and efficient.

Resident Rights dignity, respect and a comfortable living environment. quality of care and treatment without discrimination. freedom of choice to make your own, independent decisions. be informed in writing about services and fees before you enter the nursing home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.