Loading

Get Md Comptroller Mw506a 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506A online

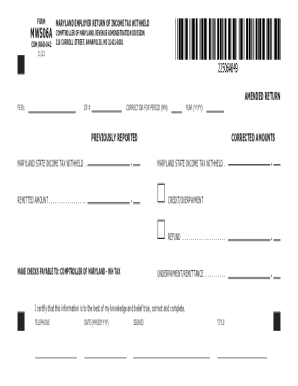

Filling out the MD Comptroller MW506A form is essential for Maryland employers to report income tax withheld from employee wages. This guide will walk you through each step of the process, ensuring that you complete the form accurately and efficiently.

Follow the steps to successfully complete the MW506A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Federal Employer Identification Number (FEIN) in the designated field. This number uniquely identifies your business for tax purposes.

- Fill in the correction for the period by entering the month (MM) in the designated section if you are filing a correction.

- Indicate whether this is an amended return by checking the appropriate box if applicable.

- Specify the tax year by entering the appropriate year (YYYY) in the provided field.

- Report the previously reported Maryland state income tax withheld in the respective field. Ensure that the amount is accurate.

- Allocate the remitted amount into the corresponding section to reflect the amount paid to the state.

- Enter the corrected amounts of Maryland state income tax withheld in the appropriate field, ensuring accuracy.

- If there is a credit or overpayment, indicate the amount in the designated field. This is important for calculating refunds.

- Identify any refund amounts from overpayments, filling in the necessary field accordingly.

- Report any underpayment or remittance in the designated section to address discrepancies.

- Provide a contact telephone number for follow-up inquiries and complete the date field (MMDDYYYY) with the submitting date.

- Sign the form to certify that the information provided is true and accurate, including your title in the designated area.

- Review all entries for accuracy before proceeding to save changes, download a copy of the form, or print it for submission.

Complete your MD Comptroller MW506A form online to ensure accurate and timely tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.