Loading

Get Ky Dor 42a804 Form K-4 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 42A804 Form K-4 online

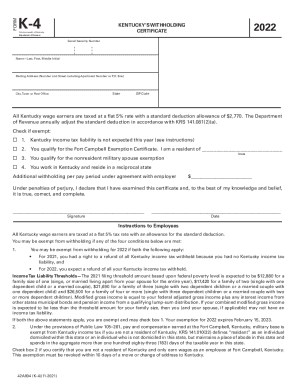

Filling out the KY DoR 42A804 Form K-4 online is a straightforward process designed to help Kentucky wage earners manage their tax withholding efficiently. This guide will provide you with step-by-step instructions on how to complete the form accurately and submit it to your employer.

Follow the steps to complete your KY DoR 42A804 Form K-4 online

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter your Social Security Number in the designated field to identify your tax records.

- Provide your name by entering your last name, first name, and middle initial in the appropriate fields.

- Fill in your mailing address, including the number and street, apartment number if applicable, or P.O. Box.

- Input your city, town or post office in the corresponding field.

- Complete the ZIP code section to ensure accurate mailing.

- Review the criteria for exemptions from withholding. If applicable, check any of the boxes that apply to your situation.

- If you wish to request additional withholding, specify the amount per pay period in the designated field.

- Sign and date the form in the provided signature and date fields, certifying the accuracy of the information.

- After completing all fields, save your changes, then download, print, or share the form as needed.

Complete your KY DoR 42A804 Form K-4 online today to ensure proper tax withholding.

Here's a quick overview of to fill out a Form W-4 in 2023. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. ... Step 2: Account for multiple jobs. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.