Loading

Get Irs 1998 Form 709

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1998 Form 709 online

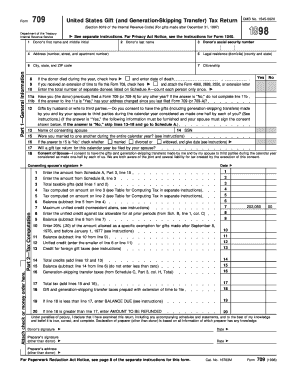

Filling out the IRS 1998 Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, can be straightforward when guided properly. This guide provides clear, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to successfully complete the IRS 1998 Form 709 online.

- To start, click the ‘Get Form’ button to access the IRS 1998 Form 709. This will allow you to obtain the document and display it in your chosen online format.

- Begin by filling out Part 1—General Information. Here, you will provide the donor's first and last name, middle initial, social security number, and address information. Make sure to indicate the legal residence and citizenship status of the donor.

- Proceed to questions about previous filings in line 11. If the donor has filed a Form 709 previously, answer accordingly. Be sure to check if any changes in address have occurred since the last filing.

- Transition to Part 2—Tax Computation, where you will enter figures from Schedule A. The lines require noting the total taxable gifts and any taxes computed based on the exemptions and credits applicable. Carefully follow the instructions for these calculations.

Start filling out your IRS 1998 Form 709 online today for a smooth and efficient process.

The Irs 1998 Form 709 is typically prepared by the individual making the gifts or by a tax professional. If you have made gifts that exceed the annual exclusion amount, you should consider using a tax expert to ensure accuracy. They can help navigate the complexities of the gift tax regulations associated with the Irs 1998 Form 709.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.