Loading

Get Ne Form 36 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 36 online

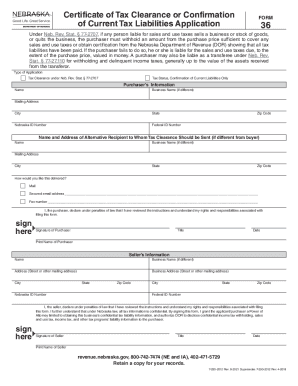

The NE Form 36 is an important document for individuals involved in the sale or transfer of a business in Nebraska. This guide provides step-by-step instructions on how to fill out the form efficiently and accurately online.

Follow the steps to complete your NE Form 36 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In the ‘Type of Application’ section, select whether you are applying for a Tax Clearance under Neb. Rev. Stat. § 77-2707 or a Tax Status, Confirmation of Current Liabilities only.

- Fill out the ‘Purchaser’s Information’ section with your name, business name (if different), mailing address, city, state, zip code, Nebraska ID number, and federal ID number.

- If applicable, complete the name and address of an alternative recipient to whom the tax clearance should be sent.

- Indicate how you would like to receive the tax clearance: by mail, secured email, or fax.

- Both the purchaser and seller must sign the form, declaring that they have reviewed the instructions and understand their rights and responsibilities.

- Fill in the ‘Seller’s Information’ section, including the name, business name (if different), and address of the seller, along with necessary identification numbers.

- After reviewing the completed form for accuracy, save your changes, download a copy, print, or share the form as needed.

Complete your NE Form 36 online today to ensure a smooth business transaction.

Related links form

2023 tax table: married, filing jointly Tax rateTaxable income bracketTaxes owed10%$0 to $22,000.10% of taxable income.12%$22,001 to $89,450.$2,200 plus 12% of the amount over $22,000.22%$89,451 to $190,750.$10,294 plus 22% of the amount over $89,450.24%$190,751 to $364,200.$32,580 plus 24% of the amount over $190,750.3 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.