Loading

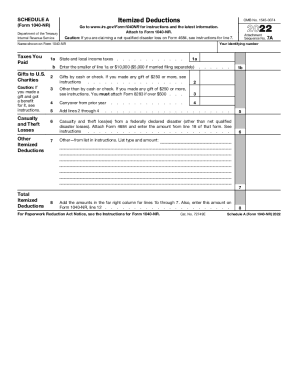

Get Irs 1040-nr - Schedule A 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-NR - Schedule A online

Filling out the IRS 1040-NR - Schedule A form online is an essential step for non-resident aliens to claim itemized deductions. This guide provides clear, step-by-step instructions to help users navigate and complete the form accurately and efficiently.

Follow the steps to fill out the IRS 1040-NR - Schedule A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the section labeled 'Gifts to U.S. Charities' and note if you made any charitable donations. You will enter the total here.

- Next, go to the 'State and local income taxes' section and enter the smaller of your total state and local taxes or $10,000 ($5,000 if married filing separately).

- In the 'Casualty and theft losses' section, if applicable, enter the amount from your federally declared disaster loss (refer to Form 4684 for instructions).

- Proceed to 'Other itemized deductions' and enter the total value of any other deductions you qualify for, ensuring you attach any necessary forms, such as Form 8283 if gifting exceeds $500.

- Sum the amounts from lines 1a through 4 to get your total itemized deductions and input this amount in the designated field.

- Review all entered information for accuracy and completeness before finalizing.

- Once satisfied, save your changes, and utilize options to download, print, or share the completed form as necessary.

Start filling out your forms online today to ensure a smooth filing process.

If you file Form 1040-NR, use Schedule NEC (Form 1040-NR) to figure your tax on income that is not effectively connected with a U.S. trade or business and to figure your capital gains and losses from sales or exchanges of property that is not effectively connected with a U.S. business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.