Loading

Get Wi I-017i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI I-017i online

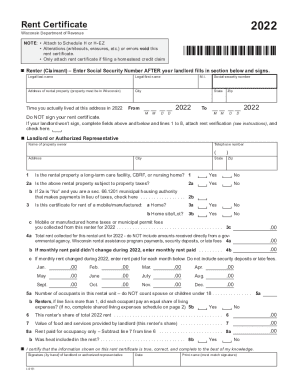

The WI I-017i is a crucial document used to declare rental amounts for the homestead credit claim in Wisconsin. This guide offers a clear, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the WI I-017i with ease.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In the 'Renter (Claimant)' section, enter your legal first name, middle initial, and last name. Provide the address of the rental property, including the city and state. Specify the time you resided at this address in the year 2022, using the appropriate month and day format.

- Do not sign the rent certificate at this point. If your landlord refuses to sign, complete the necessary fields and the designated area, then attach rent verification documents.

- In the 'Landlord or Authorized Representative' section, input the name and contact telephone number of the property owner. Provide their address, city, state, and zip code.

- Proceed to question 1 regarding the rental property type and select 'Yes' or 'No'. Continue to answer questions 2, 3, and 4 based on your rental situation, ensuring to report the correct amounts for each field.

- On line 4a, enter the total rent collected for the rental unit for the year, excluding certain payments as specified. If applicable, fill in lines 4b and 4c for monthly rent amounts.

- Complete lines 5a and 5b regarding the number of occupants and whether each occupant paid an equal share of expenses.

- Finalize your rent declaration by entering the renter’s share of total rent on line 6. Specify any value of food and services received from the landlord on line 7.

- Sign the certificate by the landlord or authorized representative, ensuring their name matches the signature provided. Review the form for completeness.

- After receiving the completed certificate, enter your Social Security number, finalize any remaining amounts on the form, and prepare to submit the rent certificate along with Schedule H or H-EZ.

Complete your documents online for a hassle-free filing experience.

A rent certificate or property tax bill is used to verify the amount of rent paid or property tax accrued you are claiming for purposes of homestead credit. If a copy of the property tax bill is not available, you may use a printout from the county or municipal treasurer or their website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.