Loading

Get Form 2325

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2325 online

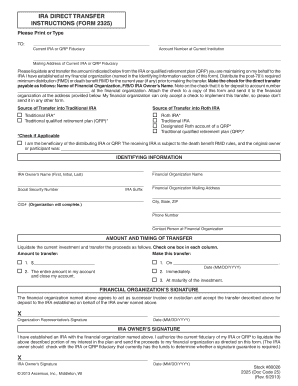

Filling out the Form 2325 is an essential process for transferring funds from your current individual retirement account (IRA) or qualified retirement plan (QRP) to a new IRA. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Form 2325 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing application.

- Begin by filling in the 'Current IRA or QRP Fiduciary' field with the name of your current financial institution.

- Next, provide your 'Account Number at Current Institution' to identify the specific account you are transferring from.

- In the 'Mailing Address of Current IRA or QRP Fiduciary' section, enter the full mailing address of your current fiduciary.

- Specify the amount you wish to transfer in the 'Amount to transfer' section, and indicate the timing for this transfer by selecting one of the provided options.

- If applicable, check the relevant boxes for the source of the transfer into either a Traditional IRA or a Roth IRA.

- Complete the 'Identifying Information' section with your financial organization name, your name, Social Security number, and mailing address.

- Each financial organization must sign and date the form to confirm they will accept the transfer on your behalf.

- Finally, sign and date the form as the IRA owner, authorizing the transfer, ensuring that you check with your current fiduciary to see if a signature guarantee is necessary.

- Once completed, save your changes, then download, print, or share the form as needed to proceed with the transfer.

Complete your Form 2325 online today for a seamless transfer process.

A trustee-to-trustee transfer typically takes anywhere from a few days to a few weeks, depending on the institutions involved. After submitting the necessary paperwork, the receiving trustee will process the transfer. It is wise to keep track of the status and use Form 2325 to document the transfer timeline. This helps you stay informed and ensures that your retirement assets are secure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.