Loading

Get Ct Drs Os-114 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS OS-114 online

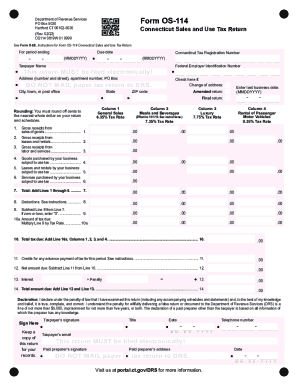

Filling out the CT DRS OS-114 form online is an essential step for anyone conducting business in Connecticut. This guide provides a clear and structured approach to help users complete this sales and use tax return accurately and efficiently.

Follow the steps to successfully complete your CT DRS OS-114 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Connecticut Tax Registration Number in the designated field.

- Provide the name of the taxpayer and the Federal Employer Identification Number (FEIN). This information details who is filing the form.

- Fill in the address fields, including the street number, apartment number if applicable, city, and ZIP code. Ensure all information is current.

- Indicate the period ending date and the corresponding due date in the specified format (MMDDYYYY).

- Select if you are filing a final return or an amended return by checking the appropriate boxes.

- Complete the gross receipts sections, entering amounts for sales of goods, leases and rentals, and labor and services in the correct columns based on their applicable tax rates.

- List any deductions as outlined in the instructions. Carefully follow the guidelines for deductions applicable to your business.

- Calculate the total tax due by multiplying the net sales amount by the appropriate tax rate, and then sum the deductions, if any.

- Sign the form to declare that the information provided is true and accurate. Include your title, date, and contact number.

- After completing all sections, save your changes, and proceed to download, print, or electronically submit the form ensuring you do not mail a paper return.

Complete your CT DRS OS-114 online today for a seamless filing experience.

Use tax applies to the purchase or lease of assets such as furniture, equipment, machines, instruments and computers. It also applies to the purchase of goods such as office supplies, paper, stationery items, certain publications, packaged software, and books which are used by the business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.