Get It 205

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 205 online

Filling out the It 205 form online can seem daunting, but with a clear understanding of each section and field, you can complete it efficiently. This guide provides step-by-step instructions to help you navigate the process with ease.

Follow the steps to successfully fill out your It 205 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

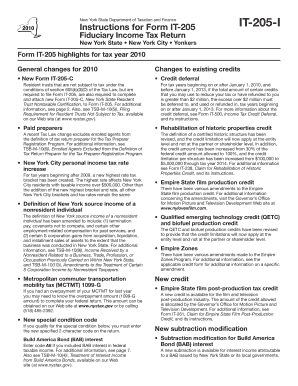

- Review the general instructions and understand who must file the It 205 form. This explanation includes details regarding resident and nonresident estates or trusts that must comply with specific filing requirements.

- Fill out the Name and Address box at the top of the form, including the name of the estate or trust, fiduciary's name, and their respective addresses.

- Indicate whether this is the initial return or a final return by marking the appropriate boxes provided on the form.

- Refer to the ‘Income’ section to report any federal taxable income and make necessary state adjustments as instructed in the guidelines.

- Complete Schedule A for reporting items of income, gain, loss, or deduction. Ensure to follow along with the federal Form 1041 lines for accuracy.

- Fill out Schedule B for the New York fiduciary adjustment, noting any specific additions or subtractions pertaining to the trust’s income.

- Transfer the fiduciary shares from Schedule C, ensuring to include all beneficiaries' details and their respective shares.

- In the New York City and Yonkers areas on the form, fill in taxes and credits applicable to the estate or trust based on the appropriate tax schedules.

- Review the completed form for any errors or missing information. Once finalized, save your changes, and proceed to download, print, or share the form as needed.

Start filling out your It 205 form online today!

To calculate your pension formula, start by identifying the plan formula provided by your pension plan, which typically involves averaging your highest years of salary and multiplying it by years of service. This formula varies by plan, so it is crucial to refer to your plan’s documentation for specifics. Accurate calculations are key to understanding your retirement benefits. For additional clarity, USLegalForms offers templates that help explain these calculations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.