Get Sc Uce-1010 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC UCE-1010 online

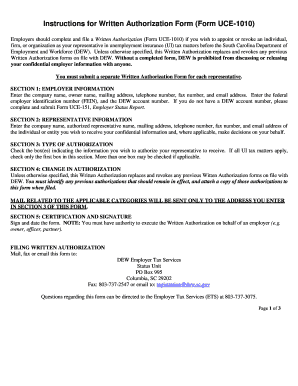

The SC UCE-1010 is a Written Authorization form that allows employers to appoint or revoke a representative in unemployment insurance tax matters. This guide provides clear and step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete the SC UCE-1010 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In Section 1, provide your employer information. Enter the company name, owner name, mailing address, telephone number, fax number, email address, federal employer identification number (FEIN), and DEW account number. If you do not have a DEW account number, you must complete and submit Form UCE-151 first.

- Move to Section 2 and fill in the representative's information. This includes the company name of the representative, authorized representative name, their mailing address, telephone number, fax number, and email address.

- In Section 3, indicate the type of authorization by checking the appropriate box(es). If you wish to authorize the representative for all unemployment insurance tax matters, check the first box. If only specific matters apply, check those relevant boxes.

- In Section 4, clarify any changes in authorization. Specify if this Written Authorization replaces previous authorizations or if certain prior authorizations should remain in effect. Attach a copy of any previous authorizations that are still valid.

- Proceed to Section 5 and provide your signature and the date. Ensure that you have the authority to execute this form on behalf of the employer.

- Once you have completed the form, you can save your changes. You may also download, print, or share the form as needed.

Complete your SC UCE-1010 document online today to ensure your unemployment insurance matters are managed effectively.

The tax on unemployment benefits in South Carolina can vary based on multiple factors, including your total benefit amount and applicable state laws. Benefits received are generally subject to federal income tax, and many individuals choose to have taxes withheld. Knowing these details helps manage your finances better after unemployment. For comprehensive information, the SC UCE-1010 form can be a helpful guide.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.