Loading

Get Mn Dor Schedule M1m 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1M online

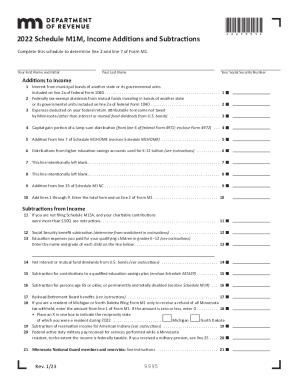

The MN DoR Schedule M1M is essential for determining specific income additions and subtractions. This guide offers step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the MN DoR Schedule M1M.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- In the first section, enter your first name and initial, last name, and Social Security number as requested.

- Next, move to the 'Additions to Income' section. Fill in the amounts for each applicable line from 1 to 10 based on your financial records.

- Proceed to the 'Subtractions from Income' section, listing your eligible deductions from lines 11 to 32. Ensure you provide the necessary details as prompted.

- Review all information entered for accuracy, ensuring it aligns with your federal tax records.

- Once you are satisfied with your entries, you have the option to save changes, download a copy of the form, print it for physical submission, or share it electronically as needed.

Complete your documents online for a streamlined tax filing experience.

Related links form

Errors on the return and further review by the Minnesota Department of Revenue can also cause a delay. Ensure your tax return is accurate and contains all necessary information. An amended tax return may also cause a refund delay and may be necessary if someone notices an error.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.