Get Ga Dor St-5 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR ST-5 online

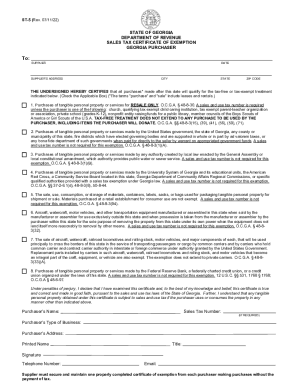

The GA DoR ST-5 form is a Sales Tax Certificate of Exemption used in the state of Georgia. This guide will provide you with step-by-step instructions for filling out this form online, ensuring you complete it accurately for tax-exempt purchases.

Follow the steps to successfully fill out the GA DoR ST-5 online.

- Press the ‘Get Form’ button to access the GA DoR ST-5 form and open it in your online editor or document management system.

- In the section labeled 'To:', enter the name of the supplier from whom you are making the purchase.

- Fill in the date on which this certificate is being completed.

- Provide the supplier’s address, including street address, city, state, and ZIP code.

- Select the applicable box to certify that your purchases will qualify for tax-free or tax-exempt treatment. Be sure to read each option carefully to ensure you are selecting the correct exemption.

- Complete the Purchaser’s Name section with your full name or the business name under which the purchases will be made.

- If required, enter your sales tax number in the designated field.

- Indicate your type of business by selecting or writing in the relevant category.

- Provide your complete address as the purchaser, which may differ from the supplier’s address.

- In the Printed Name field, write your name clearly.

- Fill in your title or position within the organization in the designated field.

- Sign the form in the Signature section.

- Include your telephone number and email address for further correspondence.

- Once the form is completed, you can save your changes, download the document, print it for your records, or share it as needed.

Complete your form online today to ensure your tax exemption is processed efficiently.

A Georgia business can purchase tangible personal property for resale without paying sales tax by providing the supplier with a properly completed Form ST-5 Certificate of Exemption.

Fill GA DoR ST-5

ST-5 Certificate of Exemption. ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Download or print the 2024 Georgia Form ST-5 (Sales Tax Certificate of Exemption) for FREE from the Georgia Department of Revenue. Property: . Vehicle registration renewal in under two minutes. Currently, combined sales tax rates in Georgia range from 4 percent to 9 percent, depending on the location of the sale. To: STATE OF GEORGIA. Qualifying entities may make purchases exempt for resale only using Form ST-5. (15.1) Sales of pipe organs or steeple bells to any church that is a tax exempt. 5. Reason for Exemption Circle the letter that identifies the reason for the exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.