Loading

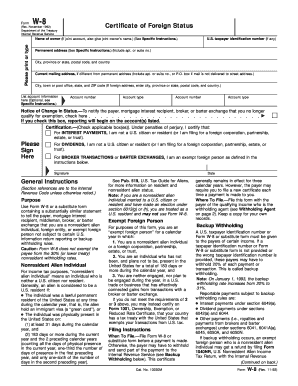

Get Form W-8 (rev. November 1992). Certificate Of Foreign Status

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8 (Rev. November 1992). Certificate of Foreign Status online

Form W-8 is a crucial document for foreign individuals and entities to certify their foreign status for U.S. tax purposes. This guide provides clear and supportive instructions on how to complete the form online, ensuring that you accurately convey your non-U.S. residency.

Follow the steps to fill out the Form W-8 online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the name of the owner in the designated field. If the account is joint, include the joint owner's name as well.

- Provide your U.S. taxpayer identification number, if you have one. Otherwise, you can leave this field blank.

- Fill out the permanent address section, including your complete address in your country of residence. If your current mailing address differs from your permanent address, provide it in the next section.

- If applicable, list any account information such as account numbers and types. This is optional but helpful if you have multiple accounts under the same payer.

- Indicate any notice of change in status if relevant. Check the box if you are notifying about a change in your status to the payer.

- Make the necessary certifications by checking the applicable box(es) that correspond with your claims about U.S. residency.

- Sign and date the form in the space provided to certify that all information is accurate.

- Save your changes. Once you have completed the form, you can download or print it for your records and share it with the appropriate parties.

Complete your Form W-8 online today to ensure compliance with U.S. tax regulations.

No, the W-8BEN is not for U.S. citizens; it is specifically for non-U.S. individuals and entities. U.S. citizens should use Form W-9 to provide their taxpayer information. The Form W-8 (Rev. November 1992) is essential for foreigners to demonstrate their status and ensure proper tax treatment in U.S. financial transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.