Loading

Get Form 5304 Rev 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5304 Rev 2000 online

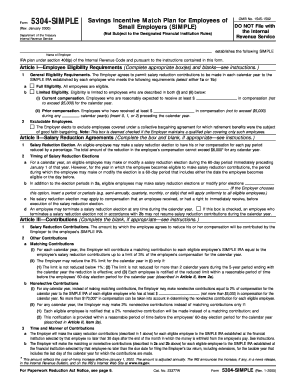

Filling out the Form 5304 Rev 2000, which establishes a SIMPLE IRA plan for employees, is an important step for employers. This guide aims to provide clear, step-by-step instructions for completing the form online, ensuring that users can navigate the process with confidence.

Follow the steps to complete Form 5304 Rev 2000 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the introductory section of the form, which outlines its purpose and the general requirements for establishing a SIMPLE IRA plan.

- In Article I, select the appropriate checkbox for employee eligibility requirements. Choose between full eligibility for all employees or limited eligibility based on compensation thresholds.

- Specify any excludable employees in Article I, such as those under collective bargaining agreements, by checking the relevant box.

- Move to Article II to elect the salary reduction agreements. If applicable, fill in the percentage or amount by which the employee's salary will be reduced, ensuring it does not exceed the annual limit.

- Complete the timing of salary reduction elections by indicating the chosen election periods in Article II.

- Proceed to Article III to indicate the employer's contribution options. Specify if you will be making matching contributions or nonelective contributions and fill in the corresponding limits.

- Review Articles IV to VII to ensure that all sections are completed, including vesting requirements, withdrawal policies, and the effective date of the plan.

- Once all information is accurately inputted and reviewed, you can save changes, download, print, or share the completed form as needed.

Start completing your Form 5304 Rev 2000 online today to ensure compliance and provide your employees with a SIMPLE IRA plan.

Yes, you will receive IRS Form 5498 for a SIMPLE IRA, which reports contributions made to the account during the year. This form also provides information about the total value of your account. Understanding the importance of this form alongside Form 53 ensures you stay informed about your retirement savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.