Loading

Get Canada T5018 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T5018 online

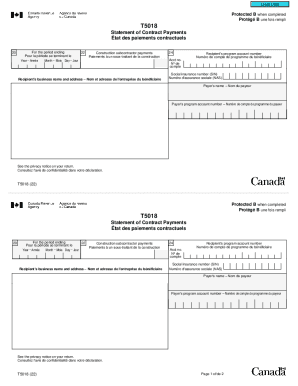

The Canada T5018 form is essential for reporting contract payments made to subcontractors in the construction industry. This guide provides clear and detailed steps to help you fill out the T5018 online accurately.

Follow the steps to complete the Canada T5018 online.

- Press the ‘Get Form’ button to obtain the Canada T5018 form and open it in your preferred online editor.

- Enter the reporting period's end date in Box 20. You should specify the last day of the month, day, and year for this period.

- In Box 22, provide the total amount of payments made to the recipient over the reporting period. Ensure this figure includes any applicable goods and services tax or harmonized sales tax.

- For Box 24, input the recipient's program account number or their social insurance number. Make sure to verify this information for correctness.

- Fill in the payer's name and program account number. Remember not to include your business number on copies distributed to subcontractors.

- Once all fields are completed, review the information for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your Canada T5018 form online today to streamline your contract payment reporting.

The T5018 form is a record of what you paid a subcontractor for construction services during the previous fiscal year. The T5018s and T5018 Summary need to be filed with the CRA on or before the date that is 6 months after the end of your fiscal year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.