Loading

Get Employee Representation Regarding Use Of Company Vehicle 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Representation Regarding Use of Company Vehicle online

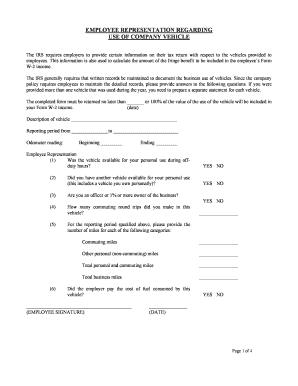

Filling out the Employee Representation Regarding Use of Company Vehicle form is essential for documenting the use of a vehicle provided by your employer. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and submit it in a timely manner.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by providing a description of the vehicle, including the make, model, and any identifying details.

- Fill in the reporting period by specifying the start and end dates of the vehicle usage.

- Document the odometer readings at the beginning and end of the reporting period.

- Answer the series of questions about personal use of the vehicle, indicating 'Yes' or 'No' as applicable.

- For the reporting period, input the total number of commuting round trips made in the vehicle.

- Input the number of miles for each specified category: commuting miles, non-commuting personal miles, total personal and commuting miles, and total business miles.

- Indicate whether the employer paid for the fuel consumed by the vehicle by selecting 'Yes' or 'No'.

- Provide your signature and date in the designated sections at the bottom of the form.

- Once you have completed the form, save your changes, download the form, or print it for submission.

Complete your documents online today for streamlined processing.

On average, a company car is worth $8,500 a year. This figure is with the assumption that the employee does not have to pay any expenses for any fuel, insurance, repair, or maintenance. If an employee is responsible for any of those expenses, they should deduct that cost from the original figure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.