Loading

Get Ks Form 200 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Form 200 online

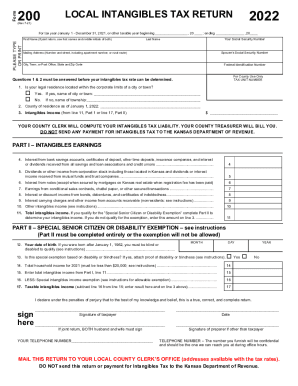

The KS Form 200 is essential for reporting local intangibles tax in Kansas. This guide provides a clear, step-by-step approach to help users complete the form online with ease.

Follow the steps to fill out the KS Form 200 online effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your personal information. This includes your first and last name, Social Security number, and mailing address. If filing jointly, include your partner's name and Social Security number as well.

- Respond to questions 1 & 2 regarding your legal residence. Indicate if your residence is within the corporate limits of a city or town and provide the name of the city or township.

- Provide the county name where you reside as of January 1, 2022.

- Complete Part I by entering details about your intangibles earnings. This section covers various income sources such as interest from savings accounts, dividends from stocks, and other intangible income.

- If you qualify for the special senior citizen or disability exemption, complete Part II. This includes providing your date of birth and total household income for 2021.

- Review all entered information for accuracy. Ensure you have attached any necessary documentation, especially for the exemption claim.

- Sign the form, ensuring that both partners sign if filing jointly, and include the date of signing.

- Once completed, save any changes you made. You can either download, print, or share the form as needed.

Take the next step in managing your tax obligations by filling out your form online today.

The intangibles tax is a local tax levied on gross earnings received from intangible property such as savings accounts, stocks, bonds, accounts receivable, and mortgages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.