Loading

Get Mn Form St101 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN Form ST101 online

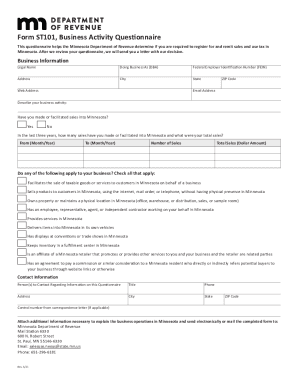

The MN Form ST101, also known as the Business Activity Questionnaire, is essential for determining your sales and use tax registration requirements in Minnesota. This guide provides a step-by-step approach to filling out the form online, ensuring a smooth experience.

Follow the steps to successfully complete the MN Form ST101 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your business information in the appropriate fields. Fill out your legal name, as well as any 'Doing Business As' (DBA) name if applicable. Don’t forget to include your federal employer identification number (FEIN), business address, city, state, ZIP code, web address, and email address.

- In the section describing your business activity, provide a clear and concise description of what your business does. This field helps clarify your operations for tax purposes.

- Indicate whether you have made or facilitated sales into Minnesota by selecting either 'Yes' or 'No'. This will determine your tax obligations.

- If you answered 'Yes' in the previous step, fill out the section regarding your sales in the last three years. Specify the number of sales made or facilitated into Minnesota and the total sales dollar amount within the specified date range.

- Review the checklist of applicable business activities. Check all that relate to your business, such as facilitating the sale of taxable items, selling products online, or having a physical presence in Minnesota.

- Provide your contact information in the provided fields, including the title, phone number, and address of the primary contact person regarding this questionnaire. If you received correspondence regarding a control number, include that as well.

- If necessary, attach additional information to explain your business operations in Minnesota. Ensure to compile all relevant documents beforehand.

- Once you have completed all sections of the form and attached any necessary documents, save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your MN Form ST101 online today to ensure compliance with Minnesota tax regulations.

Most retail sales are taxable in Minnesota. A retail sale means any sale, lease, or rental of tangible personal property (goods) for any purpose other than resale, sublease, or subrent. A retail sale also includes services for any purpose other than for resale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.