Loading

Get Dr 0449 (01/24/19)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DR 0449 (01/24/19) online

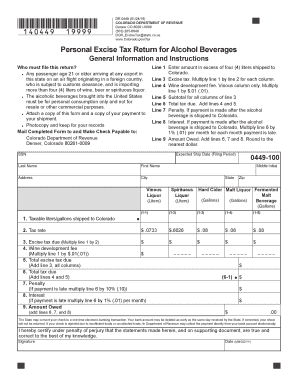

Filling out the DR 0449 form is essential for individuals importing alcoholic beverages into Colorado. This guide provides clear and detailed instructions on each section of the form to ensure a smooth online completion process.

Follow the steps to complete the DR 0449 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your personal information, including your first name, middle initial, last name, address, city, state, and zip code in the designated fields.

- Provide your social security number (SSN) in the appropriate box.

- Indicate the expected ship date for your alcoholic beverages in the 'Expected Ship Date (Filing Period)' field.

- Complete the section for taxable liters or gallons shipped to Colorado. Fill in the appropriate amounts for vinous liquor, spirituous liquor, hard cider, malt liquor, and fermented malt beverage.

- Multiply the taxable liters or gallons by the corresponding tax rates to calculate the excise tax for each type of beverage and enter the results in the designated lines.

- Add the excise tax totals to obtain the subtotal and enter this amount on the appropriate line.

- Calculate any applicable penalties or interest for late payments and total these amounts to find the overall amount owed.

- Review all entries for accuracy and completeness before finalizing the form.

- Save your changes, and you can download, print, or share the form as needed.

Complete your forms online today for a hassle-free experience.

2.9% Colorado state sales tax is imposed at a rate of 2.9%. Any sale made in Colorado may also be subject to state-administered local sales taxes. A sale may also be subject to self-collected home-rule city sales taxes, which are not administered by the Department. Sales Tax Guide - Colorado Department of Revenue colorado.gov https://tax.colorado.gov › sales-tax-guide colorado.gov https://tax.colorado.gov › sales-tax-guide

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.