Loading

Get Gst Reg 06

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst Reg 06 online

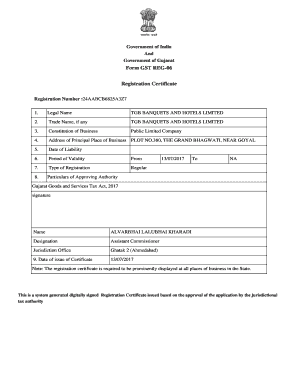

The Gst Reg 06 form is essential for obtaining a registration certificate under the Goods and Services Tax regime in India. This guide provides clear and user-friendly instructions to help users complete the form efficiently online.

Follow the steps to fill out the Gst Reg 06 form online

- Press the ‘Get Form’ button to access the Gst Reg 06 form and open it for editing.

- Fill in the legal name of the business as it appears in official documents. In this case, enter 'TGB Banquets and Hotels Limited'.

- Provide the trade name of the business if it differs from the legal name. If not, you can input the same legal name again.

- Indicate the constitution of the business. For this example, select 'Public Limited Company'.

- Enter the address of the principal place of business. For instance, you may input 'Plot No. 380, The Grand Bhagwati, Near Goyal'.

- Specify the date of liability when the business became liable for GST. Ensure it is accurately reflected.

- Mention the period of validity for your registration, including the start and end dates, if applicable.

- Select the type of registration. In this scenario, choose 'Regular' registration.

- Provide details regarding the approving authority. Include the name, designation, and jurisdiction office associated with the registration approval.

- Enter the date of issue of the certificate to finalize the application.

- Review all the entered details for accuracy. Make any necessary corrections before proceeding.

- Once all sections are completed, save your changes, and you may choose to download, print, or share the completed form as needed.

Complete your Gst Reg 06 form online today to streamline your registration process!

The GST PMT 06 payment form is crucial for taxpayers who need to make payments towards their GST liabilities. It facilitates the easy payment of tax dues and allows for accurate tracking of payments. Comprehending the Gst Reg 06 instructions can help clarify any concerns regarding this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.