Loading

Get Form 3531

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3531 online

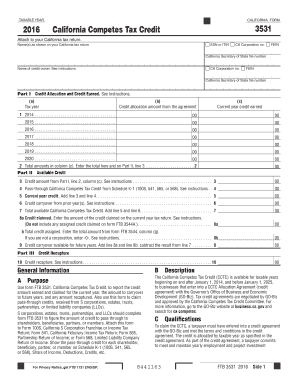

Filling out the Form 3531, California Competes Tax Credit, is essential for businesses claiming tax credits related to their agreements. This guide provides step-by-step instructions to ensure proper completion of the form online.

Follow the steps to complete Form 3531 accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), or the California Corporation number, or the Federal Employer Identification Number (FEIN) as applicable.

- Provide the name(s) as shown on your California tax return. Ensure this matches the tax documents for consistency.

- Include your California Secretary of State file number. This is crucial for identifying your business in the state records.

- In Part I, list the credit allocation and credit earned for each year specified. Start with the tax year, then input the credit allocation amount from your agreement, and finally the current year credit earned.

- Sum the current year credits and enter the total on Part II. This will facilitate an accurate assessment of your available credits.

- Indicate any pass-through California Competes Tax Credits, if applicable, using the specific line designated for these amounts.

- Complete the total available California Competes Tax Credit by adding the current year credit and any carryover from prior years.

- In Part III, address the credit recapture, if applicable, as instructed.

- Review all the information for accuracy and completeness, ensuring that all required fields are filled. Once satisfied, you can save changes, download, print, or share the completed form.

Complete your Form 3531 online today to ensure you claim all eligible tax credits.

You must use this form to authorize the IRS to contact a third party on your behalf or to revoke that authorization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.