Loading

Get Ga 501x 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA 501X online

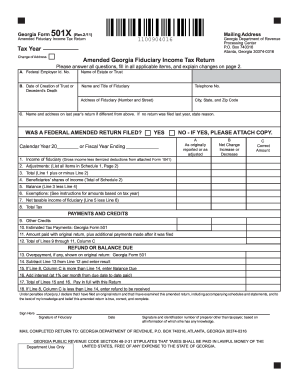

The GA 501X is the Amended Fiduciary Income Tax Return required by the Georgia Department of Revenue. Completing this form accurately is essential for reporting changes to a previously filed income tax return for estates or trusts. This guide provides a clear and supportive approach to filling out the GA 501X online.

Follow the steps to complete the GA 501X form efficiently.

- Press the ‘Get Form’ button to access the GA 501X and open it in your preferred editor.

- Begin by entering the required information in section A, which includes the federal Employer Identification Number, the name of the estate or trust, and the date of creation of the trust or decedent’s death.

- Provide details about the fiduciary in section A, including their name, title, telephone number, and complete address.

- If the address from the last year's return is different, fill in that information in section C, or state the reason if no return was filed last year.

- Indicate whether a federal amended return was filed by checking the appropriate box and attach a copy if applicable.

- In the income section, provide the gross income from the fiduciary’s activities, alongside any adjustments as outlined in the subsequent lines.

- Complete schedule 1 for adjustments, detailing any additions and subtractions to income.

- Fill in schedule 2 with the beneficiaries’ shares of income, entering their names, addresses, and identification numbers.

- In schedule 3, explain any changes made to income, deductions, and credits in detail.

- Finally, review the completed form for accuracy, sign the declaration, and include the date and any preparer's information required. Save your changes and proceed to download, print, or share the finished form.

Start filling out your GA 501X online today for a seamless tax amendment process.

Every resident and nonresident fiduciary having income from sources within Georgia or managing funds or property for the benefit of a resident of this state is required to file a Georgia income tax return on Form 501 (see our website for information regarding the U.S. Supreme Court Kaestner Decision).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.