Loading

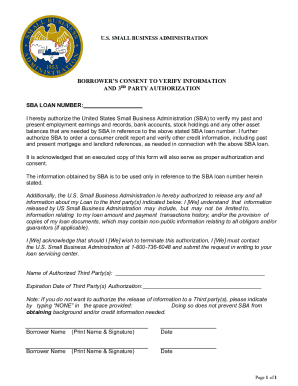

Get Sba Borrowers Consent To Verify Information And 3rd Party Authorization 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Borrowers Consent To Verify Information And 3rd Party Authorization online

Filling out the SBA Borrowers Consent To Verify Information And 3rd Party Authorization form is an important step in securing your SBA loan. This guide will provide you with clear instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to access the document and open it in your preferred editor.

- Enter the SBA loan number at the top of the form. This number is crucial for identifying your specific loan.

- Provide your authorization by checking the box next to the statement that confirms your consent to verify past and present employment earnings, records, bank accounts, and other asset information as needed.

- Acknowledge that you are authorizing the SBA to order a consumer credit report by ensuring that box is checked.

- List any third parties you authorize to receive information about your loan in the 'Name of Authorized Third Party(s)' field. This may include financial advisors or other representatives.

- Fill in the 'Expiration Date of Third Party(s) Authorization' to indicate how long this authorization is valid.

- If you do not wish to authorize the release of information to any third parties, type 'NONE' in the provided space.

- Print your name and provide your signature in the 'Borrower Name' section. Ensure that both names and signatures are included if there is more than one borrower.

- Add the date of signing in the designated 'Date' field associated with your signature.

- Once all fields are completed, save your changes. You can then download, print, or share the completed document as required.

Complete your documents online today to ensure a smooth process for your SBA loan.

The Draft Authorization is a living document and a specific contract between your lender and the SBA. It's a written agreement providing the terms and conditions under which SBA will guarantee your business loan, and will outline the specific conditions which must be met to keep the SBA guaranty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.