Loading

Get Jm Application For Taxpayer Registration (individuals) 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JM Application For Taxpayer Registration (Individuals) online

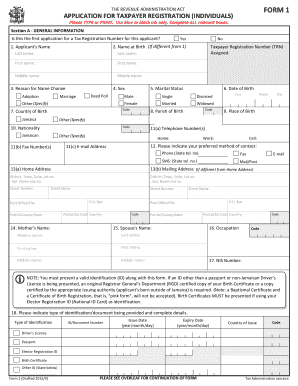

Filling out the JM Application For Taxpayer Registration (Individuals) is an essential step for individuals seeking a Tax Registration Number. This guide provides clear and detailed instructions on how to complete the application online, ensuring a smooth and efficient process.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in your browser or editor.

- In Section A, provide your general information. Indicate if this is your first application for a Tax Registration Number and fill in your name, including last name, first name, and middle name. If your name at birth is different, indicate that as well.

- Select the reason for any name changes you may have experienced, such as adoption or marriage. Ensure to provide accurate details.

- Complete the sex, date of birth, and marital status fields. Be sure to use the correct format for the date.

- Provide your country of birth and indicate your nationality. Fill in your place and parish of birth as well.

- Enter your contact information including telephone numbers and email address. Make sure these are correct for reliable communication.

- Fill in your home address and, if applicable, the mailing address if it differs from your home address. Include all required details.

- Provide the names of your mother and spouse as required. Ensure to include both maiden name and current name.

- List your occupation and National Insurance Scheme (NIS) number if applicable.

- Include information on the identification document being provided. Ensure that the document complies with the requirements stated in the form.

- If applicable, indicate whether you are carrying on a trade, business, vocation, or profession in Jamaica and provide details of your employer.

- If the application is for someone under 18 or if you are a representative, complete Section B with the representative's details.

- In Section C, read the declaration carefully, sign, and date the application. Ensure that all information is accurate.

- Once you have completed the form, save any changes and download a copy for your records. You may print or share it as necessary.

Begin the process by completing your JM Application for Taxpayer Registration (Individuals) online today.

To apply using TRN Online, you should visit the TAJ Website .jamaicatax.gov.jm and log in to the TAJ Web Portal, select the “Apply for a TRN” hyperlink from the e‐Services home page.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.