Loading

Get Ie Irish Forestry Funds Stock Transfer Form 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Irish Forestry Funds Stock Transfer Form online

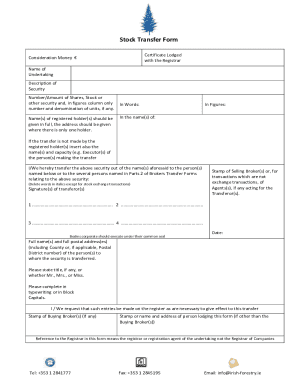

Filling out the IE Irish Forestry Funds Stock Transfer Form is a straightforward process that is essential for transferring ownership of shares. This guide will provide you with easy-to-follow instructions to help you complete the form accurately online.

Follow the steps to successfully complete the online form

- Click ‘Get Form’ button to download the stock transfer form and open it in your preferred editor.

- Begin by entering the consideration money being transferred in euros (€) in the designated field.

- Next, provide the name of the undertaking in the relevant section, ensuring it is clearly stated.

- In the description of security section, detail the type of shares or stock being transferred.

- Indicate the number and amount of shares, stock, or any other securities in the respective fields, making sure to include figures only in the designated column.

- List the full name(s) of the registered holder(s) and provide the corresponding address information for clarity.

- For the total amount of money being transferred, clearly state the amount in words and in figures.

- If the transfer is initiated by someone other than the registered holder(s), include their name(s) and role, such as executor.

- Sign the form in the areas provided for the transferor(s), ensuring all signatures are legible.

- If applicable, add the stamp of the selling broker or agent involved in the transfer.

- Fill in the date of the transfer at the appropriate section.

- Finally, include the full name(s) and postal address(es) of the individual(s) receiving the security, while noting any titles.

- Review the completion of the form to ensure all fields are filled accurately, then save your changes, download a copy, print it, or share as needed.

Complete your stock transfer forms online today for a smooth and efficient transfer process.

Related links form

Once you have filled out your J30 or J10 stock transfer form, you may need to send it to HMRC. Consider whether Stamp Duty is payable (and if so settle the amount due) Put the completed Stock Transfer Form (Stamped if applicable or unstamped if Stamp Duty not payable) with the company books.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.