Loading

Get Ssa-1398 2016-2026

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-1398 online

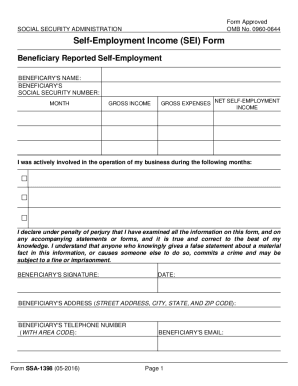

The SSA-1398 form is a crucial document for beneficiaries who report self-employment income to the Social Security Administration. This guide will provide clear, step-by-step instructions to help you complete this form online with confidence.

Follow the steps to fill out the SSA-1398 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin filling out the form by providing your name in the designated field labeled 'Beneficiary's name.' Ensure that the name matches the documentation on file with the Social Security Administration for accuracy.

- Enter your Social Security number in the 'Beneficiary's Social Security number' field. This number is essential for identification and processing by the SSA.

- Indicate the gross income for the months you were self-employed. Clearly differentiate between gross income and net self-employment income to avoid errors.

- Next, fill in your gross expenses in the relevant field. Maintain an accurate record of all business-related expenses to substantiate your claims.

- Calculate your net self-employment income by subtracting your gross expenses from your gross income. Make sure this calculation is correct, as it directly impacts your benefits.

- State the months during which you were actively involved in the operation of your business. This information is vital for the SSA’s tracking purposes.

- Sign and date the form in the designated areas. The signature confirms the accuracy of the information provided and acknowledges the legal implications of submitting false information.

- Provide your complete address, including street address, city, state, and zip code to ensure proper communication from the Social Security Administration.

- Input your telephone number with the area code in the specified field for potential follow-ups or inquiries by the SSA.

- Include your email address in the appropriate section to facilitate electronic communication regarding your submissions.

- Once you have filled out all the required fields, review your entries for completeness and accuracy. Make any necessary corrections.

- Finally, save your changes, download a copy for your records, print the completed form if necessary, or share it via the provided options.

Complete your SSA-1398 form online today to ensure your self-employment income is reported accurately.

Self-employed individuals can prove their income through various other documentation such as invoices, bank statements, profit and loss statements and tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.