Get Usda Debt Ratio Waiver Request/payment Shock Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign USDA Debt Ratio Waiver Request/Payment Shock Form online

How to fill out and sign USDA Debt Ratio Waiver Request/Payment Shock Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting and intricate tax and legal paperwork has concluded. With US Legal Forms, finalizing official documents is stress-free. A powerful editor is right at your fingertips, providing you with various helpful tools for completing a USDA Debt Ratio Waiver Request/Payment Shock Form. These instructions, along with the editor, will assist you throughout the entire process.

We streamline the process of completing any USDA Debt Ratio Waiver Request/Payment Shock Form significantly. Begin today!

- Hit the Get Form button to start improving.

- Activate the Wizard mode in the upper toolbar for extra guidance.

- Complete every fillable section.

- Make sure the information you enter into the USDA Debt Ratio Waiver Request/Payment Shock Form is current and precise.

- Add the date to the form with the Date feature.

- Press the Sign option and create a digital signature. You have three choices: typing, drawing, or capturing one.

- Ensure every field is filled out correctly.

- Select Done in the top right corner to save or transmit the form. There are multiple options for receiving the document: as an email attachment, a printed copy via mail, or as an instant download.

How to Modify Get USDA Debt Ratio Waiver Request/Payment Shock Form: Personalize Forms Online

Leave behind the conventional paper-based method of managing the Get USDA Debt Ratio Waiver Request/Payment Shock Form. Have the paperwork finished and signed swiftly with our expert online editor.

Are you obliged to update and complete the Get USDA Debt Ratio Waiver Request/Payment Shock Form? With a professional editor like ours, you can accomplish this task in mere minutes without the hassle of printing and scanning documents back and forth. We offer fully customizable and user-friendly document templates that serve as a starting point to assist you in filling out the required form online.

All forms automatically include fillable sections that can be completed as soon as you open the form. However, if you need to enhance the existing content of the form or add new details, you can choose from a variety of editing and annotation features. Emphasize, obscure, and comment on the text; insert checkmarks, lines, text boxes, images, notes, and annotations. Additionally, you can swiftly authenticate the form with a legally-binding signature. The finalized document can be shared with others, stored, imported to external applications, or converted into any widely-used format.

Selecting our web-based tool to finalize the Get USDA Debt Ratio Waiver Request/Payment Shock Form is a sound decision because it is:

Don’t waste time editing your Get USDA Debt Ratio Waiver Request/Payment Shock Form the outdated way—with pen and paper. Opt for our comprehensive solution instead. It provides a diverse range of editing tools, integrated eSignature functionalities, and convenience. What sets it apart from similar options is the collaborative capabilities—allowing you to work together on documents with anyone, establish an organized document approval process from start to finish, and much more. Experience our online solution and obtain the best value for your investment!

- Simple to set up and use, even for those new to online document completion.

- Powerful enough to accommodate various editing requirements and document types.

- Safe and secure, ensuring your editing experience is protected at all times.

- Accessible across multiple operating systems, making it easy to complete the document from anywhere.

- Able to generate forms based on pre-prepared templates.

- Compatible with numerous document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

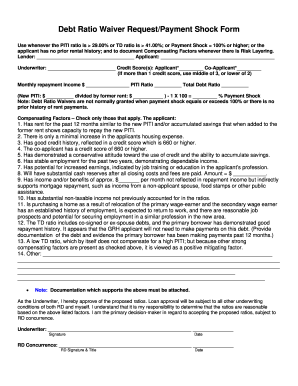

When buying a house, the maximum debt-to-income ratio usually caps at 43%. However, many lenders, including those working with USDA loans, might allow higher ratios in certain circumstances. Utilizing the USDA Debt Ratio Waiver Request/Payment Shock Form can present an opportunity for approval beyond traditional limits. It assesses your unique situation to find potential pathways for homeownership.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.