Loading

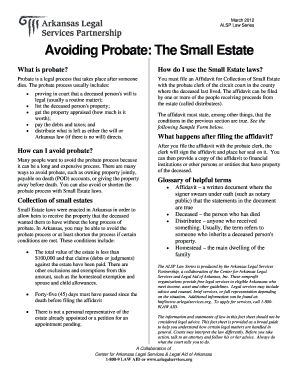

Get Ar Avoiding Probate: The Small Estate 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Avoiding Probate: The Small Estate online

Filling out the AR Avoiding Probate: The Small Estate form can facilitate a smoother transition of assets without navigating the often lengthy probate process. This guide will walk you through each step to ensure your form is completed accurately and efficiently.

Follow the steps to fill out the form online:

- To begin, use the 'Get Form' button to access the AR Avoiding Probate: The Small Estate form. This action allows you to open the document in an editable format.

- Review the form's instructions carefully to understand the required information and ensure all necessary fields will be completed.

- Enter the full name of the deceased individual in the designated area, ensuring accuracy to avoid potential issues in processing.

- Provide the total value of the estate, making sure it does not exceed the limit of $100,000 as specified by the Small Estate laws.

- Confirm that the conditions for filing are met: ensure that forty-five days have passed since the death and that there is no personal representative already appointed.

- List the names of the distributees, those who will inherit the property, in the spaces provided to clarify who will receive the estate.

- Once all fields are filled, review your entries for any errors, ensuring that all information is accurate and complete.

- After reviewing, save the changes to your form. You can then choose to download, print, or share the completed document for filing.

Begin the process of completing your documents online today.

Related links form

Property that is jointly owned with a survivorship right will avoid probate. If one owner dies, title passes automatically to the remaining owner. There are three types of joint ownership with survivorship rights: Joint tenancy with rights of survivorship.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.