Loading

Get Ms Dor Form 80-108 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR Form 80-108 online

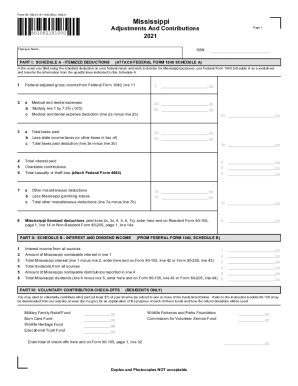

The MS DoR Form 80-108 is essential for itemizing deductions and contributions for Mississippi tax purposes. This guide provides a clear and supportive framework for users on how to complete the form online, ensuring accurate and timely submissions.

Follow the steps to complete the MS DoR Form 80-108 online

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Complete the taxpayer name section and input your Social Security number (SSN).

- In Part I, Schedule A - Itemized Deductions: Attach Federal Form 1040 Schedule A as instructed, and transfer the necessary information from your federal return. Start by entering your federal adjusted gross income from Federal Form 1040, line 11.

- Fill in medical and dental expenses in line 2a. Then, multiply line 1 by 7.5% and enter the result in line 2b. Calculate your medical and dental expense deduction by subtracting line 2b from line 2a and enter the result in line 2c.

- In line 3, enter the total taxes paid in line 3a, and subtract any state income taxes (or other taxes in lieu of) in line 3b for the total taxes paid deduction in line 3c.

- Continue filling out the form by listing the total interest paid in line 4, total charitable contributions in line 5, and total casualty or theft loss in line 6 if applicable.

- For other miscellaneous deductions, input amounts in lines 7a, 7b, and calculate line 7c by subtracting line 7b from line 7a. Complete the required calculations to arrive at your Mississippi itemized deductions.

- In Part II, Schedule B - Interest and Dividend Income: Enter total interest income from all sources in line 1, followed by the amount of Mississippi nontaxable interest in line 2. Calculate the total Mississippi interest in line 3.

- List total dividends from all sources in line 4 and the amount of Mississippi nontaxable distributions in line 5 to derive total Mississippi dividends.

- In Part III, Voluntary Contribution Check-Offs: If you wish to donate part of your refund to specific funds, follow the instructions to make your selections.

- Complete Part IV and Part V as directed, entering any additional income, losses, or other details required.

- After filling out all sections, ensure that all information is accurate. Save your changes, and then choose to download, print, or share the form.

Start completing your MS DoR Form 80-108 online today.

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.