Loading

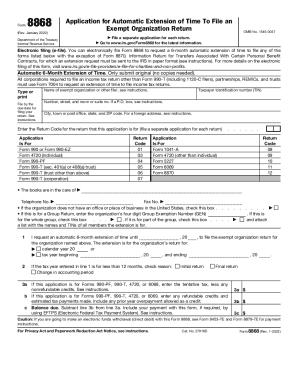

Get Irs 8868 2022-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8868 online

Filing Form 8868 is essential for exempt organizations seeking to request an automatic 6-month extension for their tax return. This guide provides clear, step-by-step instructions to help users of all experience levels navigate the completion of this form online.

Follow the steps to successfully complete your IRS 8868 application.

- Click ‘Get Form’ button to access the IRS Form 8868 and open it in your preferred online editor.

- Fill in the name of the exempt organization or filer in the designated field. Ensure that it is typed or printed clearly to avoid processing delays.

- Enter the taxpayer identification number (TIN) associated with the organization.

- Provide the organization's address, including the street number, suite number, city, state, and ZIP code. For foreign addresses, follow the specific format provided in the instructions.

- Indicate the Return Code that corresponds to the type of return for which you are requesting an extension. Make sure to enter only one code and file a separate Form 8868 for each return.

- In line 1, request the automatic 6-month extension by specifying the due date of the return. This date should not be later than 6 months from the original due date.

- If the tax year is less than 12 months, check the appropriate box to indicate the reason for the shorter period.

- Complete lines 3a, 3b, and 3c with the estimate of tentative tax and any payments or credits made. It is essential to provide this information even if you do not expect a tax liability.

- Once all fields are completed accurately, review the information for any errors or omissions.

- Finalize your submission by saving your changes. You can then download, print, or share the completed form as necessary.

Complete your IRS 8868 application online today for a seamless extension process.

IRS recommends the electronic filing of extension Form 8868 for faster processing of the 501c3 tax return and to get status instantly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.